North America Sports Drinks Market Trends Forecast 2025-2033

North America Sports Drinks Market Size and Share Analysis: Growth Trends and Forecast Report 2025–2033

Market Overview

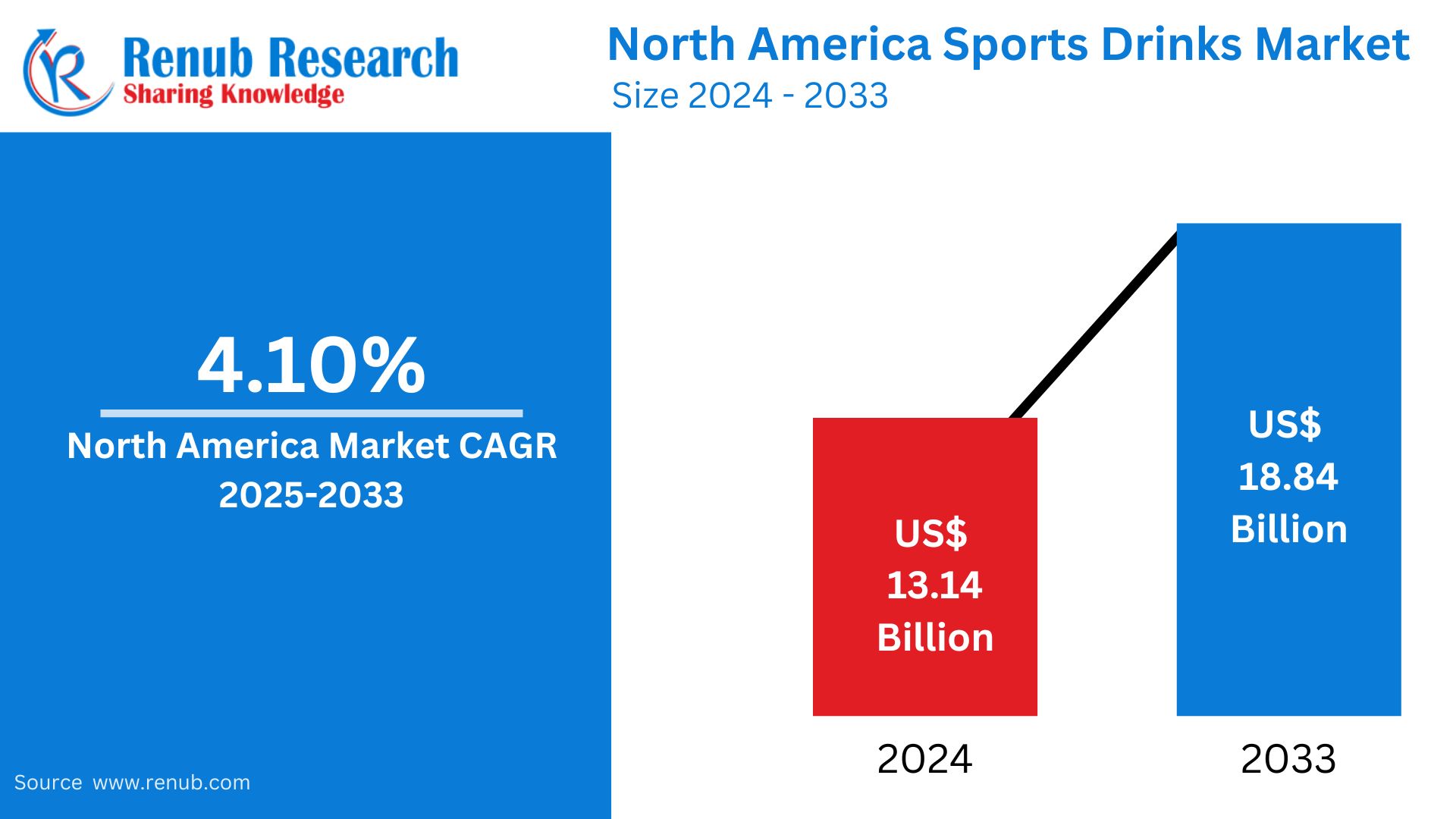

The North America Sports Drinks Market is projected to reach US$ 18.84 billion by 2033, growing from US$ 13.14 billion in 2024, at a CAGR of 4.10% during the forecast period 2025–2033. This growth is primarily driven by increasing health awareness, rising demand for hydration and recovery solutions, functional beverage innovation, and greater participation in sports and fitness-related activities across the region.

Industry Dynamics

Key Market Drivers

1. Health and Fitness Awareness on the Rise

North Americans are becoming more health-conscious and inclined towards active lifestyles. This behavioral shift has propelled demand for sports drinks that replenish electrolytes, support recovery, and boost endurance. These drinks are not just confined to athletes anymore—they are gaining traction among general consumers practicing yoga, gym workouts, or outdoor sports.

2. Surge in Sports and Recreational Activities

With a rise in both amateur and professional sports participation, there’s a growing need for beverages that maintain hydration and energy levels. Sports drinks are playing a pivotal role by offering fast hydration, preventing cramping, and aiding muscle recovery, making them a go-to choice for fitness enthusiasts.

3. Growing Popularity of Functional Beverages

Consumers now expect more than basic hydration. They seek multi-functional beverages that provide additional nutritional value—such as added vitamins, minerals, protein, and natural ingredients. Brands are addressing this by innovating new product lines featuring low-sugar, plant-based, and clean-label options.

4. Digital Commerce & Widening Availability

The proliferation of e-commerce platforms has expanded the accessibility of sports drinks, particularly niche and specialty brands. Online retail offers a broader selection, contributing to the market’s regional penetration and customer base diversification.

Emerging Market Trends

Clean Label and Natural Ingredients in High Demand

According to 2022 data, 64% of U.S. consumers prefer beverages with transparent, natural ingredients. This has led to major brands reformulating products, eliminating artificial sweeteners, and introducing clean-label options. For instance, PepsiCo launched plant-based Muscle Milk, while Gatorade introduced an unflavored water product to align with evolving preferences.

Sustainability as a Purchase Motivator

In 2022, 82% of North American consumers expressed a willingness to pay more for sustainably packaged products. This has pushed companies like Coca-Cola to commit to making 25% of their packaging reusable by 2030, with a noticeable shift toward recycled PET bottles and eco-friendly formats across the industry.

Related Report

Europe Protein Based Sports Drinks Market

Europe Protein Based Sports Drinks Market

Market Challenges

1. Consumer Skepticism and Perception Issues

Despite growing adoption, many casual consumers question the necessity of sports drinks, particularly those who engage in low-intensity workouts. Traditional variants are sometimes seen as unnecessary or too sugary, leading some consumers to choose simpler alternatives like water or coconut water.

2. Competition from Alternative Beverages

The market faces stiff competition from plant-based hydration drinks, flavored bottled water, and coconut water—perceived as healthier and more natural. These alternatives often boast organic, low-calorie, and additive-free labels that appeal to the modern health-conscious audience.

Regional Market Insights

United States Sports Drinks Market

As the largest market in North America, the U.S. showcases a vibrant sports drink ecosystem supported by a well-established fitness culture and health-forward consumers. Brands are introducing low-sugar and nutrient-enriched options to appeal to both athletes and wellness enthusiasts. Despite rising competition from plant-based beverages, innovation in flavors and functionality keeps the market strong.

Canada Sports Drinks Market

The Canadian market is expanding gradually with increased participation in fitness, recreational sports, and outdoor activities. Consumers demand drinks that are both functional and clean, driving product development with natural ingredients, added minerals, and reduced sugar content. However, competition and sugar concerns remain a challenge.

Mexico Sports Drinks Market

In Mexico, the shift toward healthier living and rising gym culture is boosting demand. Sports drinks that support electrolyte replenishment and recovery are increasingly popular. The market is witnessing a transition, with consumers seeking nutritious, clean-label options and plant-based alternatives amid growing awareness about health and diet.

Market Segmentation

By Soft Drink Type

- Electrolyte-Enhanced Water

- Hypertonic

- Hypotonic

- Isotonic

- Protein-based Sport Drinks

By Packaging Type

- Aseptic Packages

- Metal Cans

- PET Bottles

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Key Companies in the North America Sports Drinks Market

- Abbott Laboratories

- Aje Group

- Bluetriton Brands Holdings, Inc.

- Congo Brands

- Costco Wholesale Corporation

- Keurig Dr Pepper, Inc.

- Monster Beverage Corporation

- PepsiCo, Inc.

- Sabormex SA de CV

Report Details

| Feature | Description |

| Base Year | 2024 |

| Historical Period | 2020–2024 |

| Forecast Period | 2025–2033 |

| Market Units | US$ Billion |

| Segments Covered | Soft Drink Type, Packaging Type, Distribution Channel, Country |

| Countries Covered | United States, Canada, Mexico, Rest of North America |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF & Excel (PPT/Word on Request) |

Key Questions Answered in the Report

- What is the expected market size of the North America sports drinks industry by 2033?

- What is the forecasted CAGR from 2025 to 2033?

- What are the major growth drivers of the sports drinks market in North America?

- How are consumer preferences shifting toward clean-label and functional beverages?

- Which packaging formats dominate the North America market?

- How is sustainability influencing purchasing decisions?

- Which distribution channels are driving sales growth?

- What challenges does the market face from alternative beverages?

- Who are the key players and innovators in the region?

- How does the U.S. market compare with Canada and Mexico in terms of performance?