Saudi Arabia Coffee Market Trends Forecast 2025-2033

Saudi Arabia Coffee Market Size, Trends, Growth & Forecast (2025–2033)

By Type (Instant Coffee, Ground Coffee, Whole Grain, Others), Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, Others), and Company Analysis

Market Overview

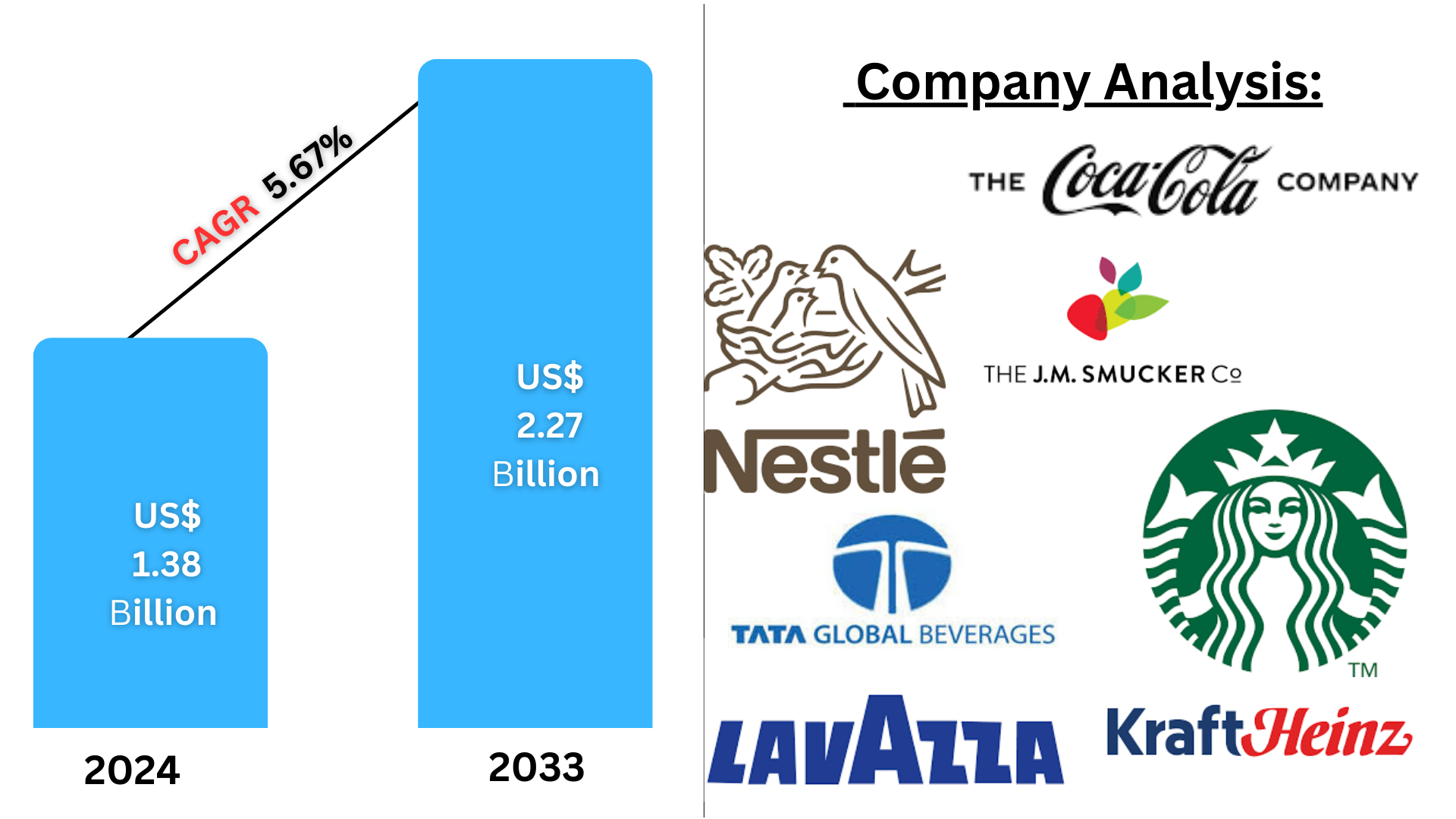

The Saudi Arabia Coffee Market was valued at USD 1.38 Billion in 2024 and is projected to reach USD 2.27 Billion by 2033, growing at a CAGR of 5.67% from 2025 to 2033. This remarkable growth trajectory is driven by cultural affinity for coffee, a booming café culture especially among the youth, and significant government initiatives such as the Saudi Coffee Initiative under Vision 2030.

Coffee, known locally as Gahwa, is an integral part of Saudi tradition and hospitality. As the country progresses with its economic diversification efforts, coffee is not only a cultural icon but also a strategic industry.

Market Drivers

1. Cultural Significance & Traditional Practices

Coffee holds deep-rooted cultural importance in Saudi society, symbolizing hospitality, respect, and social bonding. Traditional Saudi coffee, made from lightly roasted beans mixed with cardamom and other spices, is served during social and religious gatherings. Its continued cultural relevance helps maintain strong and stable demand, ensuring a blend of heritage with innovation.

Highlights:

- National events boost awareness of Saudi coffee traditions.

- Government-backed programs promote Gahwa as a national symbol.

- The proclamation of 2022 as the “Year of Saudi Coffee” solidifies coffee’s cultural value.

2. Growing Café Culture Among the Youth

Urbanization, exposure to global trends, and the social preferences of millennials and Gen Z are transforming Saudi Arabia’s coffee consumption landscape. Cities like Riyadh, Jeddah, and Dammam have witnessed a proliferation of specialty coffee shops and international coffee chains.

Key Stats:

- As of May 2023, Saudi Arabia’s population was 32.2 million.

- 63% of citizens are under the age of 30.

- Coffee consumption is increasingly driven by Instagrammable experiences and quality brews.

3. Government Support under Vision 2030

The Saudi Coffee Initiative, part of the broader Vision 2030, aims to develop the entire coffee value chain—from cultivation to consumption. The Saudi Coffee Company, established by the Public Investment Fund (PIF), is investing $319 million over 10 years to grow the industry, particularly in regions like Jazan known for Arabica production.

Key Plans:

- Increase production from 300 tonnes to 2,500 tonnes annually.

- Cultivate 1.3 million coffee trees by 2025.

- Establish barista training academies and coffee franchises.

Emerging Market Trends

1. Rise of Specialty Coffee

The growing demand for high-quality, single-origin, and ethically sourced beans has paved the way for specialty coffee brands. Consumers are increasingly interested in artisanal coffee with unique flavors and brewing techniques.

2. Sustainable and Local Sourcing

The government and private sector are promoting sustainable farming practices and supporting local farmers through training and financing. Brands like JAZEAN focus on sustainability and traceability.

3. E-Commerce & Digital Ordering

Digital platforms and mobile apps are accelerating online coffee sales and café services. Online retail is gaining traction, especially among tech-savvy urban consumers.

Related Report

Europe Ready to Drink Coffee Market

United Arab Emirates Ready Drink Tea and Coffee Market

Saudi Arabia Ready Drink Tea and Coffee Market

Recent Industry Developments

- May 2024: Saudi Coffee Company received a license to open a factory in Jazan to support local coffee production.

- March 2024: Alghanim Industries entered a partnership with Saudi Coffee Company to promote the Jazean brand internationally.

- July 2024: Gulf Trading Company launched the “Al Rifai” line, expanding the premium coffee segment.

- September 2023: The launch of JAZEAN by Saudi Coffee Company emphasized quality, sustainability, and Saudi identity.

Market Segmentation Analysis

By Type

- Instant Coffee – Most popular for convenience.

- Ground Coffee – Gaining traction in premium and specialty segments.

- Whole Grain – Increasingly used by cafes and home brewers.

- Others – Includes coffee pods and capsules, slowly growing.

By Distribution Channel

- Supermarkets and Hypermarkets – Primary source for at-home consumption.

- Convenience Stores – Important for impulse and ready-to-drink options.

- Online Retail – Rapidly growing due to tech adoption and urbanization.

- Others – Includes vending machines and specialty outlets.

Competitive Landscape

The Saudi coffee market is characterized by the presence of both global giants and emerging local players. International chains are expanding aggressively while local brands are gaining consumer trust through authenticity and quality.

Key Players

- The J. M. Smucker Company

- The Kraft Heinz Company

- Nestlé SA

- Starbucks Coffee Company

- Luigi Lavazza SPA

- Tata Global Beverages

- The Coca-Cola Company

Each company is investing in product innovation, sustainability, and distribution to tap into the growing Saudi market.

Future Outlook: 2025–2033

The future of Saudi Arabia’s coffee industry looks promising as the country seeks to be recognized both as a coffee consumer and producer on the global stage. With strong government backing, rising domestic production, expanding café chains, and a youthful population eager to embrace global coffee trends, the market is poised for sustained long-term growth.

FAQs – Saudi Arabia Coffee Market

- What is the Saudi Arabia Coffee Market?

The market includes the production, distribution, and consumption of various coffee types and encompasses both retail and café sectors. - What are the main drivers of the Saudi Arabia Coffee Market?

Cultural traditions, a youthful population embracing café culture, and strategic government support under Vision 2030. - What types of coffee are popular in Saudi Arabia?

Instant coffee, traditional Gahwa, ground and specialty coffees. - How has the café culture influenced the market?

Café culture has driven growth in specialty coffee, social coffee consumption, and international brand penetration. - What challenges does the market face?

Climatic limitations for coffee cultivation, import dependency, and maintaining authenticity amid commercialization. - How are local producers performing?

Supported by state investments, local producers are scaling up production and gaining visibility through branding and partnerships. - What are the emerging trends?

Specialty brews, sustainable sourcing, digital ordering, and coffee tourism. - What is the future of the Saudi coffee market?

Strong growth potential driven by domestic production goals and a booming café culture.

Report Details

| Feature | Details |

| Base Year | 2024 |

| Historical Period | 2020 – 2024 |

| Forecast Period | 2025 – 2033 |

| Market Size | USD Billion |

| Segments Covered | Type & Distribution Channel |

| Distribution Channels | Supermarkets, Convenience Stores, Online Retail, Others |

| Companies Covered | 7 Key Players |

| Customization Scope | 20% Free Customization |

| Analyst Support | 1 Year Post-Sale |

| Delivery Format | PDF, Excel (Word/PPT on request) |

Need a Custom Report?

Talk to our analysts to tailor this report to your strategic goals or business operations. We offer:

- Regional insights

- Competitive benchmarking

- Production and trade analysis

- Customized segmentation

- Market entry strategies

📧 Email us: [email protected]

📞 Call: USA +1-678-302-0700 | INDIA +91-120-421-9822