United Kingdom Energy Drinks Market Trends Forecast 2025-2033

United Kingdom Energy Drinks Market Size and Share Analysis: Growth Trends and Forecast Report 2025–2033

Market Summary

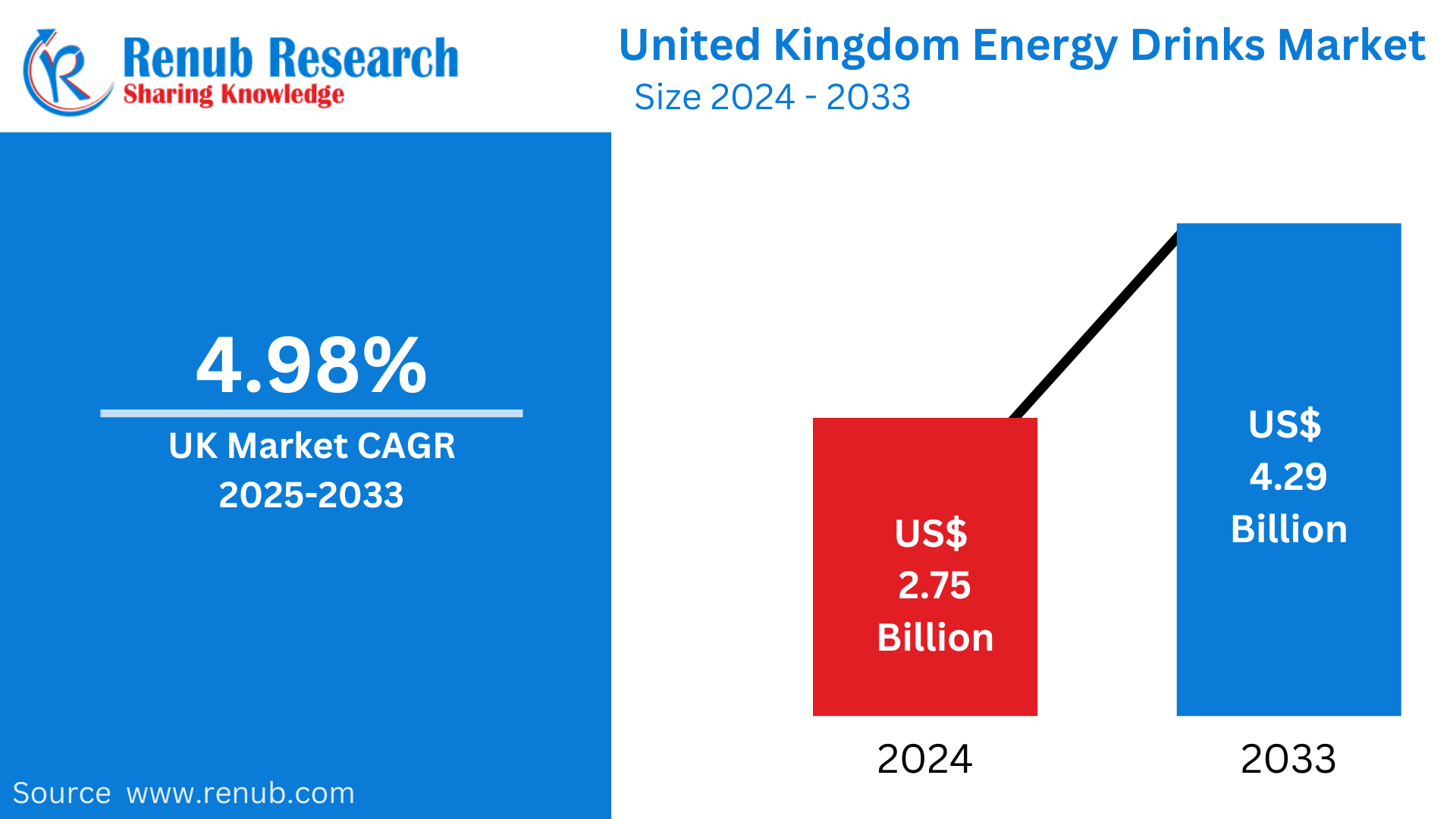

The United Kingdom Energy Drinks Market is projected to reach US$ 4.29 Billion by 2033, rising from US$ 2.75 Billion in 2024, growing at a CAGR of 4.98% during the forecast period (2025 to 2033). This growth is fueled by evolving consumer preferences, increased demand for convenience-based nutrition, and broader retail access through supermarkets, hypermarkets, online stores, and specialist outlets.

As consumers prioritize both functionality and wellness, energy drinks are adapting with reformulations, natural ingredients, and low-sugar variants. This sector is a dynamic blend of lifestyle trends, health concerns, and fast-paced urban culture, particularly among youth and working professionals.

Industry Overview

The energy drinks industry in the UK has undergone remarkable transformation over the past decade. Traditionally associated with young adults and athletes, these beverages are now consumed by a diverse demographic ranging from students and professionals to the elderly seeking quick mental or physical stimulation.

Key Industry Highlights:

- Widespread adoption by consumers aged 18–34.

- Top brands: Red Bull, Monster, and PepsiCo’s Rockstar continue to dominate.

- New entrants: Niche and wellness-oriented players offering organic and plant-based alternatives.

- Functional beverages increasingly include nootropics, adaptogens, and natural caffeine.

Despite increasing market penetration, the segment faces regulatory pressure related to health effects, particularly sugar and caffeine levels.

Key Market Drivers

1. Product Innovation and Natural Formulations

Manufacturers are constantly introducing new flavors, clean-label formulations, and sustainable packaging. Functional ingredients like ginseng, guarana, L-theanine, and green tea extract are becoming mainstream. For example:

- Tenzing’s Super Natural Energy (2024): Marketed as the world’s strongest natural energy drink.

- Lucozade Bluecozade Range (2024): Aimed at sport and energy consumers seeking new flavor innovations.

2. Tech-Enabled Production Advances

Energy drinks now leverage AI in formulation and packaging design. Notably:

- Hell Energy AI (2024) introduced in the UK: First AI-formulated beverage featuring zero preservatives, extra vitamins, and fruity flavor blends.

3. Rising Health-Consciousness

Demand for sugar-free, low-calorie, and organic energy drinks is soaring. The introduction of sugar taxes and dietary awareness campaigns has further catalyzed a shift toward healthier alternatives. Companies are reformulating products to align with these changing consumer expectations.

4. Convenience and Urban Lifestyles

Modern consumers value on-the-go energy. Energy drinks serve as portable solutions for students, professionals, and athletes. Their instant consumption capability without preparation has made them a staple in fast-paced urban life.

Related Report

Europe Sugar Free Energy Drinks Market

Home Energy Management System Market

Web Application Firewall Market

Market Challenges

1. Regulatory Scrutiny on Sugar and Caffeine

With public health agencies raising concerns about high sugar and caffeine intake, energy drink manufacturers must adhere to stricter labeling and sales regulations, especially concerning minors. Reformulating for lower sugar without compromising flavor or function remains a challenge.

2. Competition from Functional Alternatives

The rise of cold brews, matcha, yerba mate, and herbal teas presents strong competition. These beverages are perceived as cleaner, more natural energy sources, appealing to wellness-focused consumers. Energy drink brands must continue innovating to retain market share.

Regional Analysis

London

London is the UK’s largest energy drink market. With its dense population of students, professionals, and fitness enthusiasts, the city exhibits high consumption rates, especially of premium and natural variants. London’s nightlife and hospitality industries also fuel demand.

East of England

Cities like Cambridge and Norwich drive demand, especially among students and working-class consumers. Retail outlets and gyms are the main distribution points. Health concerns are nudging growth toward organic and low-sugar offerings.

Scotland

With vibrant cities like Glasgow and Edinburgh, the Scottish market is robust. However, it is under pressure to address youth consumption concerns and evolving regulatory standards. Healthy energy variants are gaining ground in response.

Yorkshire and the Humber

Home to cities like Leeds and Sheffield, this region sees strong energy drink adoption among young adults and professionals. The fitness trend is boosting consumption, though sugar and caffeine concerns are pushing for product diversification.

Market Segmentation

By Packaging Type

- Cans

- PET Bottles

By Product Type

- Non-organic

- Organic

- Natural

By Target Consumer

- Teenagers

- Adults

- Geriatric Population

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialist Stores

- Online Retail Stores

- Others

By Region

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and the Humber

- East Midlands

- Others

Key Company Profiles

Each key player is analyzed based on Overview, Key Person, Recent Developments, and Revenue:

- Suntory Holdings Limited

- Red Bull GmbH

- Monster Energy Company

- The Coca-Cola Company

- GlaxoSmithKline PLC

- Global Trade Holdings Co., Ltd.

- PepsiCo Inc.

- Max Muscle Nutrition

- TSI Consumer Goods GmbH

- Nestlé SA

Market Outlook: 2025–2033

The energy drinks market in the UK is well-positioned for sustained growth. As health consciousness, digital branding, and eco-consciousness continue to rise, companies will need to innovate around functionality, transparency, and sustainability. The emergence of AI-driven product development, clean-label trends, and customizable nutrition could reshape the competitive landscape.

Report Scope

| Feature | Detail |

| Base Year | 2024 |

| Historical Period | 2020–2024 |

| Forecast Period | 2025–2033 |

| Market | US$ Billion |

| Segments Covered | Packaging Type, Product, Target Consumer, Distribution Channel, Region |

| Companies Covered | Suntory, Nestlé, Red Bull, Monster, Coca-Cola, PepsiCo, and others |