North America Savory Snacks Market Trends Forecast 2025-2033

North America Savory Snacks Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

Market Overview

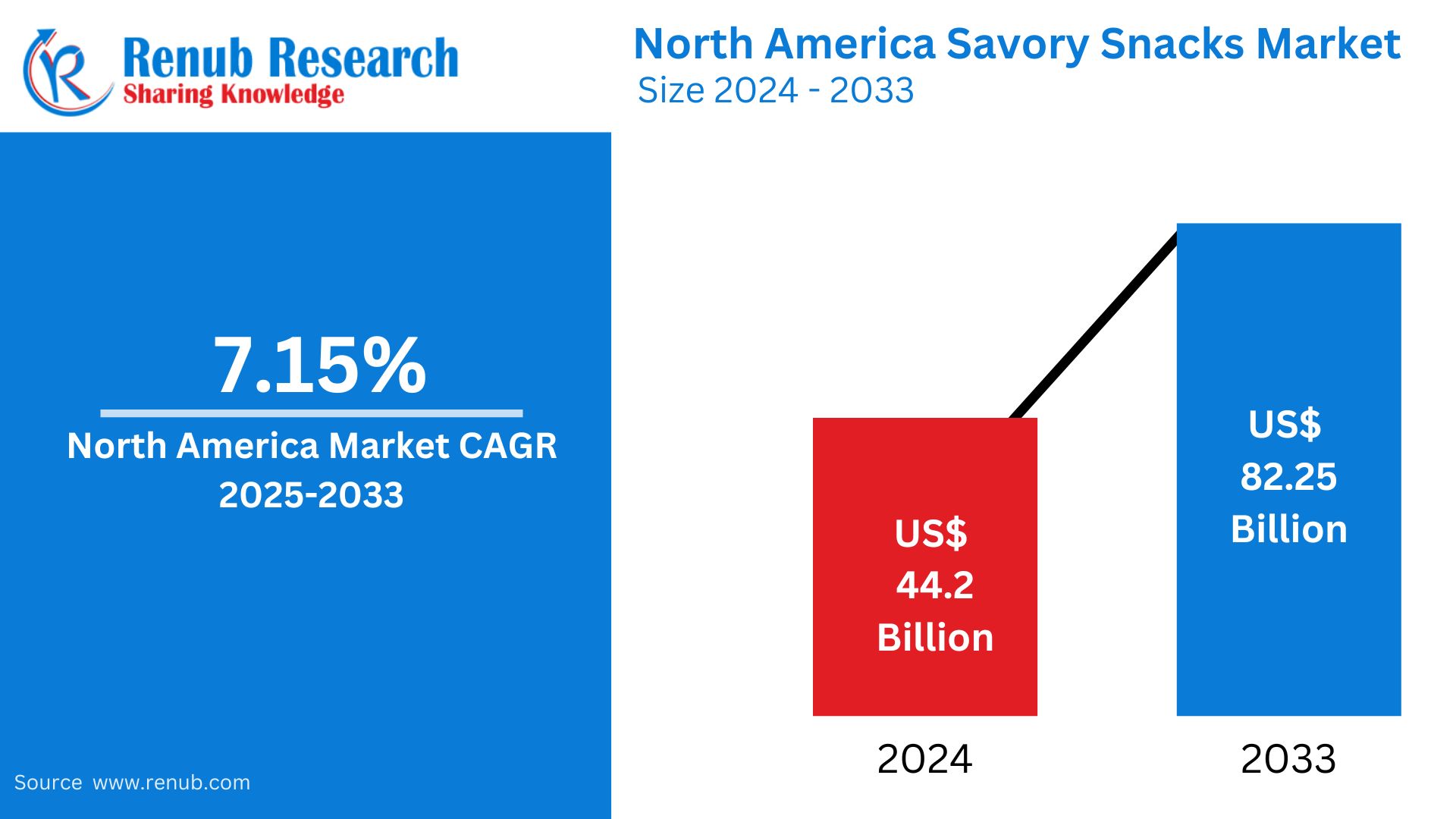

The North America savory snacks market is experiencing steady growth, driven by a shift in consumer behavior towards healthier, convenient, and flavorful snacking options. In 2024, the market was valued at US$ 44.2 billion, and it is projected to reach US$ 82.25 billion by 2033, expanding at a CAGR of 7.15% during the forecast period 2025 to 2033.

This growth is being fueled by increased demand for products like baked snacks, protein-rich munchies, and clean-label alternatives, which are progressively replacing traditional fried snacks. The industry is also witnessing a premiumization trend where consumers are seeking out high-quality ingredients and globally inspired flavors.

Market Dynamics

Key Drivers

1. Rising Demand for Convenient & On-the-Go Foods

With increasingly hectic lifestyles, consumers in North America prefer snacks that are ready-to-eat, portable, and easy to store. Products like cheese sticks, meat jerky, and resealable snack packs appeal to working professionals, students, and busy families. For instance, Ornua Foods’ Kerrygold Cheese Snacks launched in 2023 cater to this need with their convenient, high-protein format.

2. Health-Conscious Consumer Shift

Today’s consumers are looking for snacks that balance indulgence and nutrition. This has led to a spike in demand for low-sodium, gluten-free, high-fiber, and plant-based snacks. Companies like RXBAR (Kellogg) have responded with protein-packed granola featuring simple, clean ingredients.

3. Flavor Innovation and Premiumization

Flavor experimentation is reshaping the savory snacks landscape. From gourmet spices to ethnic flavor infusions, consumers are drawn to unique, intense tastes. This is coupled with a growing preference for premium, organic, and artisanal snack brands.

4. E-Commerce and Direct-to-Consumer Channels

Online sales of savory snacks are surging as consumers embrace the convenience of home delivery, subscription snack boxes, and access to international brands. Retail giants and niche platforms alike are expanding their savory snack offerings to meet this digital demand.

Key Challenges

1. Health Concerns Around Traditional Potato Chips

Rising health awareness is discouraging the consumption of deep-fried, high-fat, high-sodium snacks. As a result, manufacturers must reformulate products to retain flavor and texture while offering healthier profiles like air-popped or baked chips.

2. Intensifying Market Competition

The market is crowded with private labels, multinationals, and startups, all battling for shelf space. Price sensitivity among consumers leads to margin pressure, compelling brands to invest more in innovation, marketing, and promotions.

Related Report

South Africa Meat Snacks Market

Segment-Wise Market Analysis

By Product Type

- Potato Chips: Facing competition from better-for-you options; reformulation and baked versions are trending.

- Extruded Snacks: Innovations in shapes, textures, and flavors attract younger demographics.

- Nuts & Seeds: Regarded as high-protein, nutrient-dense snacks; a favorite among health-conscious consumers.

- Popcorn: Considered a healthy, high-fiber option; variety of flavors like spicy caramel and butter truffle are driving sales.

- Others: Includes vegetable chips, rice crackers, and alternative protein snacks.

By Flavor Profile

- Roasted/Toasted: Dominates health-conscious segments; especially in nuts, seeds, and legumes.

- Barbeque & Spice: Continues to be mainstream with regional preferences influencing flavor choices.

- Meat & Savory Blends: Includes jerky, smoked flavors, and meat-based seasoning—catering to high-protein diet trends.

- Others: Novel flavors such as cheese-bacon, sriracha-honey, and international blends are gaining ground.

By Distribution Channel

- Supermarkets/Hypermarkets: Remains the largest distribution channel; offers bulk and promotional deals.

- Specialty Retailers: Rising due to consumer demand for premium, artisanal, and ethnic snacks.

- Convenience Stores: Strong demand from urban and student populations for grab-and-go snack formats.

- Online Stores: Gaining major traction via direct-to-consumer models and online marketplaces.

- Others: Includes vending machines, institutional sales, etc.

Country-Wise Market Analysis

United States

The largest market in the region, the U.S. is characterized by:

- A diverse portfolio of snack offerings (organic, indulgent, protein-rich).

- Strong brand competition and high consumer loyalty.

- Innovation from startups and legacy players alike (e.g., KIND’s Gen Z campaign).

Canada

- Focus on natural, organic, and domestic snacks.

- Multicultural society fuels demand for international snack options.

- Retailers are adapting to health-conscious preferences (e.g., Protein Candy launch in 2024).

Mexico

- Consumer preference leans toward bold and spicy flavors.

- Traditional favorites like tortilla chips and chili nuts dominate.

- Growth driven by rising urbanization, middle-class expansion, and cross-border product exposure (e.g., Sigma’s Chocke-Obleas).

Category Highlights

North America Popcorn Market

With its low-calorie and high-fiber appeal, popcorn is a top pick for health-conscious snackers. Gourmet popcorn brands offering sweet-savory combos are expanding their footprint both in stores and online.

Roasted/Toasted Snacks Market

Innovative products like chickpea puffs, spiced pumpkin seeds, and flavored almonds cater to the keto and protein-rich diet crowd. This segment aligns well with the wellness movement.

Meat Snacks Market

Meat-based snacks such as turkey jerky, meat bars, and plant-based meat alternatives are in demand for their protein content and shelf-stable convenience.

Competitive Landscape

Major Companies Analyzed

- PepsiCo

- Mondelēz International

- THE HERSHEY COMPANY

- The Kraft Heinz Company

- General Mills Inc.

- Kellanova

- Utz Brands, Inc.

- LINK SNACKS, INC.

- Conagra Brands, Inc.

These players are focusing on R&D, M&A, product innovation, and sustainability initiatives to stay ahead.

Key Market Insights

| Feature | Details |

| Base Year | 2024 |

| Historical Period | 2021–2024 |

| Forecast Period | 2025–2033 |

| Market Unit | US$ Billion |

| Segment Coverage | Product, Flavor, Distribution Channel, Country |

| Country Coverage | United States, Canada, Mexico |

| Customization Scope | 20% Free |

| Post-Sale Support | 1-Year Analyst Support |

| Delivery Format | PDF, Excel, PPT/Word (on request) |

Key Questions Answered

- What is the projected market size of the North America savory snacks market by 2033?

- What is the expected CAGR between 2025 and 2033?

- Which product segments are driving the most growth?

- What are the top trends influencing consumer preferences in savory snacks?

- How are health and wellness shaping the product development pipeline?

- What are the key distribution channels and how are they evolving?

- What are the main challenges faced by traditional potato chips manufacturers?

- How is the growth of e-commerce impacting savory snack sales?

- What are the latest product innovations transforming the category?

- Which companies are leading the North American savory snack industry?