North America Snack Bar Market Trends Forecast 2025-2033

North America Snack Bar Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

Market Summary

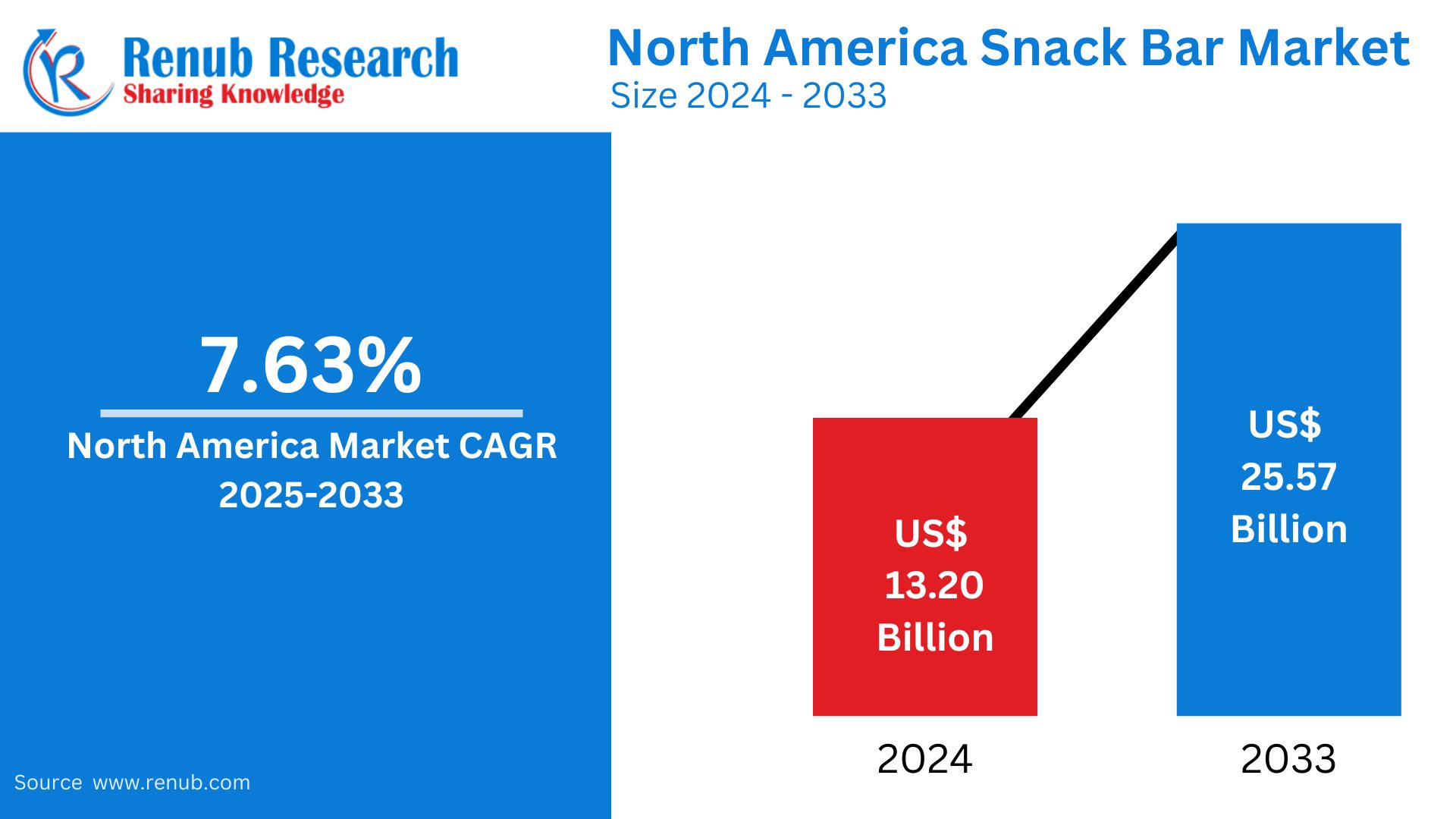

The North America snack bar market is projected to grow significantly, reaching US$ 25.57 billion by 2033 from US$ 13.20 billion in 2024, expanding at a CAGR of 7.63% during the forecast period 2025–2033. The increasing demand for nutritious, convenient, and on-the-go food solutions, coupled with the rising popularity of plant-based and functional diets, is fueling this market expansion.

Market Dynamics

Key Growth Drivers

- Health-Conscious Consumers

- Rising awareness about clean-label, nutrient-rich diets.

- Demand for protein, fiber, and healthy fats.

- Increasing interest in functional benefits like immune support, energy boosts, and digestive health.

- Convenience and On-the-Go Consumption

- Busy lifestyles leading to higher demand for quick snacks.

- Snack bars used as meal replacements, especially during commutes or workouts.

- Rise of Plant-Based and Specialty Diets

- Emergence of keto, low-sugar, vegan, and gluten-free snack bars.

- Use of alternative ingredients like pea protein, hemp, superfoods, etc.

Challenges

- High Production Costs

- Expensive sourcing of premium and organic ingredients.

- Rising costs of sustainable packaging and eco-friendly production.

- Intense Market Competition

- Saturation due to numerous established and emerging brands.

- Difficulty in maintaining product differentiation and brand loyalty.

Market Trends

- Functional Snack Bars: Driven by growing gym memberships and wellness-focused lifestyles.

- Customization and Innovation: Products catering to diverse dietary needs.

- Retail Shift: Big-box retailers creating space for niche snack products.

- Snacking Behavior: Over 90% of U.S. consumers eat snacks regularly; 51% consume snack bars.

Related Report

North America Protein Bar Market

Regional Insights

United States

- Leading the North America market in terms of revenue.

- Consumers preferring low-sugar, plant-based, and functional options.

- Retailers such as Walmart and Kroger introducing dedicated aisles for healthy snack alternatives.

Canada

- Steady market growth driven by demand for healthy and portable food.

- Popularity of protein-rich and gluten-free snack bars.

- Preference for natural ingredients and nutritional add-ons.

Mexico

- Rapid growth fueled by increasing health awareness.

- Shift toward plant-based and high-protein snacks.

- Market still challenged by price sensitivity and traditional snack competition.

Market Segmentation

By Confectionery Variant

- Granola/Muesli Bars

- Energy Bars

- Nutrition Bars

- Cereal Bars

- Fruit and Nut Bars

- Others

By Distribution Channel

- Convenience Store

- Online Retail Store

- Supermarket/Hypermarket

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Competitive Landscape

All Key Players Covered from Four Viewpoints:

- Overview

- Key Persons

- Recent Developments

- Revenue

Key Companies Profiled:

- Abbott Laboratories

- Core Foods

- General Mills Inc.

- Go Macro LLC

- Jamieson Wellness Inc.

- Kellogg Company

- Mars Incorporated

- Mondelēz International Inc.

- PepsiCo Inc.

Report Details

| Feature | Details |

| Base Year | 2024 |

| Historical Period | 2020–2024 |

| Forecast Period | 2025–2033 |

| Market | US$ Billion |

| Segment Covered | By Confectionery Variant, By Distribution Channel, By Country |

| Countries Covered | United States, Canada, Mexico, Rest of North America |

| Companies Covered | 9 Major Players |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF & Excel (Editable PPT/Word on request) |

Key Questions Answered in the Report

- What is the projected market size of the North America snack bar market by 2033?

- What is the expected CAGR of the snack bar market from 2025 to 2033?

- What are the key factors driving the growth of the snack bar market in North America?

- How is the rise of plant-based and alternative diets influencing the snack bar industry?

- What are the major challenges facing snack bar manufacturers in the region?

- Which distribution channels are considered in the segmentation?

- What percentage of U.S. consumers consumed snack bars in 2022?

- How is the demand for functional and clean-label snack bars evolving?

- Which regional markets are expected to show the fastest growth?

- Who are the major players in the North America snack bar market and what are their recent developments?

For more insights or a customized version of this report, please contact Renub Research.