United Kingdom Dairy Alternatives Market Trends Forecast 2025-2033

United Kingdom Dairy Alternatives Market Size and Share Analysis: Growth Trends and Forecast Report 2025-2033

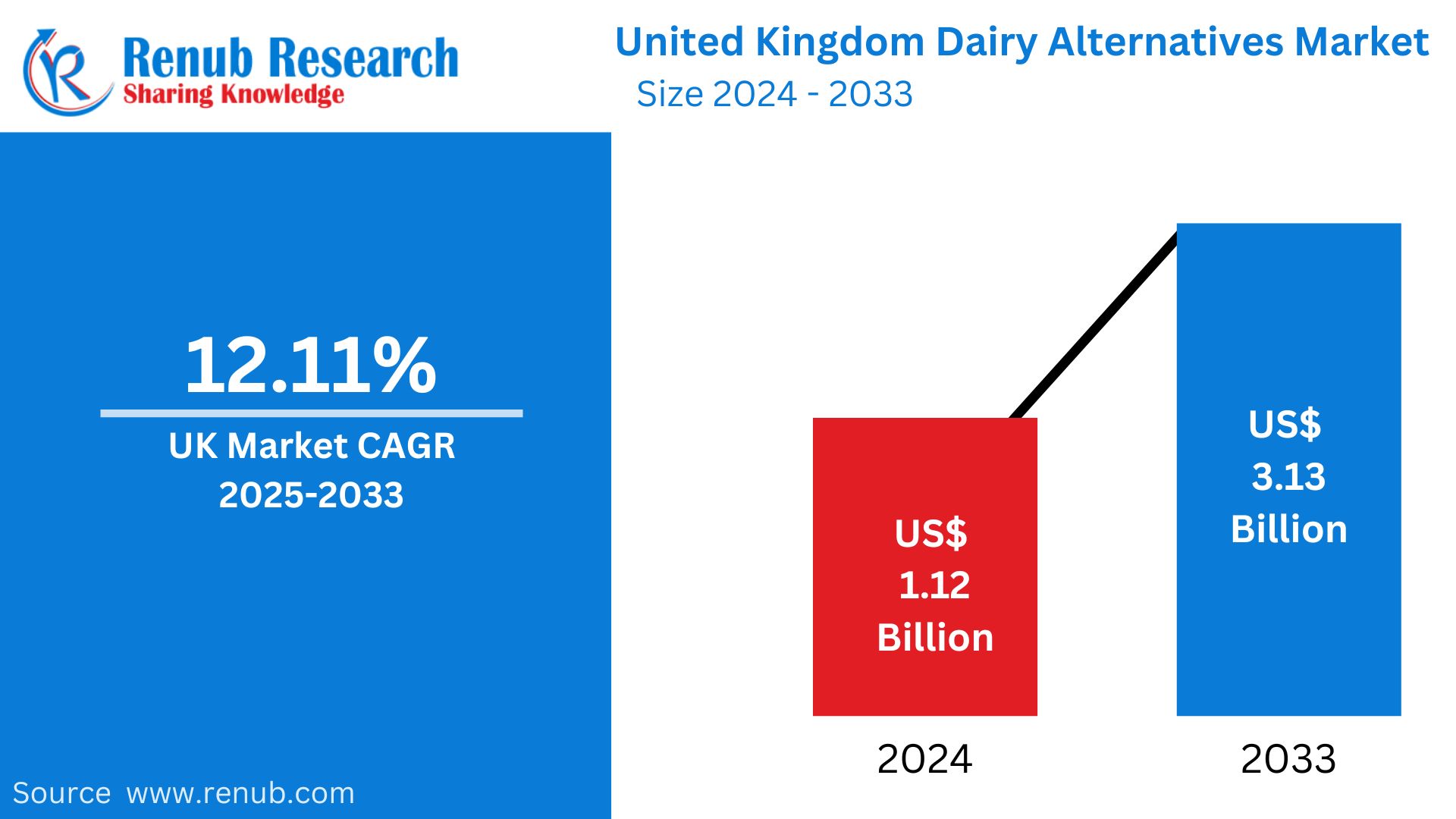

The United Kingdom Dairy Alternatives Market is projected to reach US$ 3.13 billion by 2033, rising from US$ 1.12 billion in 2024, growing at a CAGR of 12.11% during the forecast period 2025 to 2033. The surge in demand is driven by a mix of environmental awareness, ethical food choices, health consciousness, and the rapid rise of veganism and plant-based diets.

Market Dynamics

1. Rising Health Awareness and Lifestyle Changes

The market is primarily fueled by growing health concerns. A large portion of the UK population is shifting towards healthier dietary habits. With over 62.3% of adults overweight or obese in 2022, many are turning to dairy-free options that are lower in saturated fats and cholesterol. Plant-based milks, especially oat, almond, and soy, offer added nutrients like calcium and vitamin D, appealing to both health-conscious and lactose-intolerant consumers.

2. Environmental and Ethical Considerations

Environmental impact and animal welfare have become critical factors influencing consumer decisions. Consumers are opting for dairy alternatives that reduce greenhouse gas emissions and water usage. These concerns are particularly significant among millennials and Gen Z who value sustainability and ethical consumption.

3. Veganism and Flexitarian Diets on the Rise

The UK has witnessed a significant rise in veganism and flexitarianism. There are approximately 8.7 million flexitarians in the UK today. This shift has resulted in increased consumption of dairy-free products like oat milk, plant-based yogurts, and vegan cheese.

4. Affordability and Price Competitiveness

Price competitiveness has enhanced the appeal of dairy alternatives. As of October 2022, soy milk was priced at USD 1.28/litre compared to USD 1.52/litre for traditional cow’s milk. This affordability, combined with innovative product offerings, has helped capture price-sensitive consumers.

Market Segmentation Analysis

By Product Type:

- Milk: Dominates the segment with varieties like almond, soy, oat, and coconut milk.

- Yogurt: Increasing demand due to rising health trends and snack consumption.

- Cheese: Gaining traction but still developing in terms of texture and taste.

- Ice Creams: Popular among lactose-intolerant and vegan consumers.

- Creamers and Others: Witnessing niche yet steady growth.

By Source:

- Oats: Leading due to creamy texture and low allergen profile.

- Almond: Popular for its nutty flavor and low-calorie profile.

- Soy: Long-standing market player with high protein content.

- Coconut, Rice, Hemp, Others: Growing in popularity due to varied taste preferences.

By Distribution Channel:

- Supermarkets and Hypermarkets: Primary sales channel due to wide accessibility.

- Convenience Stores: Gaining ground due to on-the-go demand.

- Online Stores: Booming, especially post-pandemic, with doorstep delivery and discounts.

- Others: Includes cafes, restaurants, and specialty stores.

Related Report

United Arab Emirates Dairy Market

Saudi Arabia Organic Dairy Market

Regional Insights

London

The capital leads the market with a highly health-aware, vegan, and ethnically diverse population. Supermarkets and cafes actively stock a wide variety of dairy-free alternatives. London is also a hotspot for startups and innovation in plant-based food products.

East of England

Cities like Cambridge and Norwich drive growth with their young, student-dominated populations and sustainability-oriented consumers. Retailers in this region are rapidly expanding their dairy-free product ranges.

Scotland

Major cities such as Glasgow and Edinburgh are at the forefront of the plant-based movement. There’s growing availability of vegan milk, cheese, and yogurt in cafes and restaurants, especially in urban areas.

Yorkshire and the Humber

This region is witnessing a shift toward organic and lactose-free dairy substitutes due to increasing environmental and health concerns. Local demand is being met by both major brands and artisanal producers.

Market Drivers

1. Influence of Celebrity Endorsements and Social Media

Vegan celebrities and health influencers are promoting dairy alternatives on platforms like Instagram and TikTok. Campaigns featuring real user reviews, recipes, and testimonials help brands build trust and expand reach.

2. Technological Advancements and Product Innovation

Continuous R&D in improving flavor, texture, and shelf life is helping plant-based dairy alternatives compete with traditional products. Fortified alternatives with protein, calcium, and probiotics are especially popular.

Market Challenges

1. Taste and Texture Gaps

Despite progress, plant-based alternatives still lag behind traditional dairy in terms of flavor and texture. This gap is particularly noticeable in cheese products, which affects adoption among non-vegans.

2. Supply Chain Constraints

Price volatility and raw material shortages (like oats, almonds, soy) affect manufacturing. Increasing demand also calls for enhanced production capabilities, which may require significant investment in infrastructure and logistics.

Competitive Landscape

The UK dairy alternatives market is highly competitive with both global and domestic players:

Key Players:

- Arla Foods

- Blue Diamond Growers

- Britvic PLC

- Coconut Collaborative Ltd

- Danone SA

- Oatly Group AB

- Plamil Foods Ltd

- The Hain Celestial Group Inc.

- Upfield Holdings BV

- VBites Foods Ltd

Company Analysis Includes:

- Overview

- Key Executives

- Recent Developments

- Revenue Insights

Future Outlook

With increasing awareness, innovative product development, and the growing flexitarian population, the UK dairy alternatives market is poised for sustained expansion. Consumer demand for clean-label, fortified, and sustainable products will continue driving the transformation of this industry.

Report Scope

| Feature | Details |

| Base Year | 2024 |

| Historical Period | 2020 – 2024 |

| Forecast Period | 2025 – 2033 |

| Market | USD Billion |

| Segments Covered | Product Type, Source, Distribution Channel, and Region |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, etc. |

| Companies Analyzed | Arla Foods, Danone, Oatly, Hain Celestial, VBites, etc. |