South Africa E-Commerce Market Trends Forecast 2025-2033

South Africa E-Commerce Market Size, Share & Forecast 2025–2033

Industry Trends, Growth Drivers, Opportunities, Challenges, Segments, and Competitive Landscape

Market Overview

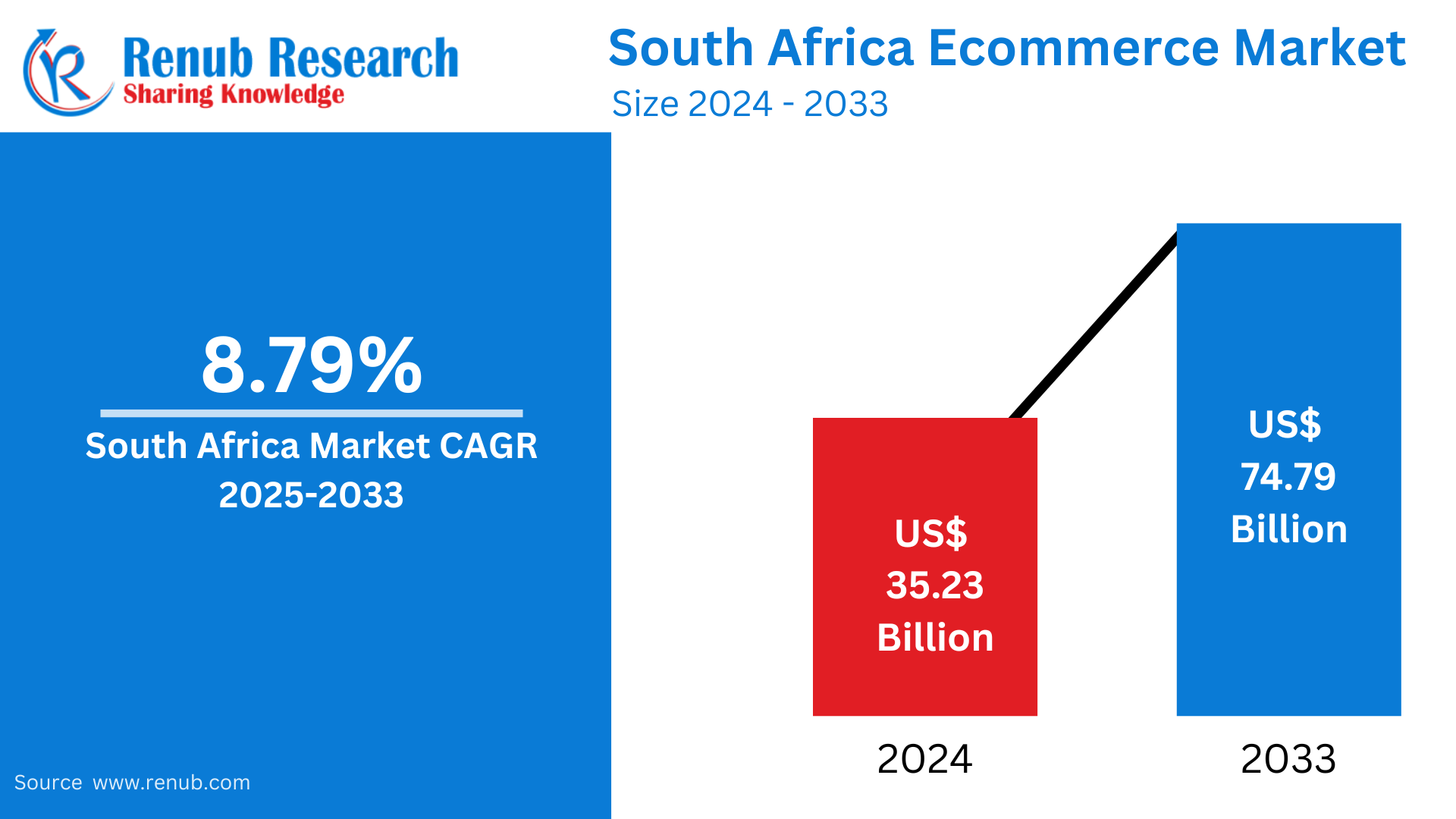

The South Africa e-commerce market is poised for significant transformation and expansion in the coming decade. The market size is projected to grow from US$ 35.23 billion in 2024 to US$ 74.79 billion by 2033, registering a CAGR of 8.79% from 2025 to 2033. With a dynamic retail landscape, increasing internet penetration, rising mobile usage, and shifting consumer preferences, the South African e-commerce sector is becoming a vital driver of the digital economy.

This surge is supported by technological innovation, strategic investments in logistics, broader digital payment adoption, and growing trust in online shopping platforms. Key players such as Takealot, Zando, Jumia, and Walmart are leveraging localized strategies to attract a diverse, tech-savvy consumer base.

Key Market Drivers

1. High Internet and Smartphone Penetration

As of January 2024, 74.7% of South Africans have internet access, and the number of internet users reached 118.6 million (including multiple device ownership). Affordable data plans, expanding 4G/5G networks, and budget-friendly smartphones are helping bridge the digital divide, even in semi-urban and rural areas. This connectivity enables seamless access to online marketplaces across the country.

2. Digital Payment Evolution

The South African e-commerce market is witnessing strong growth in cashless transactions. Digital wallets like SnapScan, Zapper, and global platforms such as Apple Pay and Google Pay are seeing increased adoption. The South African Reserve Bank’s Digital Payments Roadmap (Vision 2025) promotes interoperability, innovation, and financial inclusion — key pillars driving the digital economy forward.

3. Changing Consumer Behavior

Post-pandemic, consumer habits have shifted toward digital-first purchasing patterns. The convenience of home delivery, access to a wide variety of goods, and competitive pricing comparisons have made online shopping mainstream. Additionally, time-saving benefits and a preference for contactless shopping are driving demand across demographics.

4. Rise of Mobile Commerce (M-Commerce)

A growing number of consumers now shop via smartphones, particularly in fashion, electronics, and grocery segments. Mobile-optimized apps, targeted promotions, and simplified checkout processes have led to increasing engagement and conversion rates.

5. Market Entry of Global Players

In May 2024, Amazon launched its operations in South Africa, intensifying competition in the e-commerce space. This entrance, alongside strong local players like Takealot and Zando, is reshaping pricing strategies, logistics efficiency, and consumer expectations.

Major Challenges

1. Logistics and Delivery Infrastructure

While major cities like Johannesburg, Cape Town, and Durban have efficient delivery systems, rural and remote areas face significant logistical hurdles. Poor road infrastructure, lack of warehousing, and expensive last-mile delivery remain pain points. Companies must invest in innovative solutions like micro-fulfillment centers and gig economy-based delivery to scale inclusively.

2. Online Payment Security Concerns

Consumer concerns about cybersecurity, phishing attacks, and data breaches persist. While trusted gateways like PayFast have improved transaction confidence, a large segment remains skeptical. Increased cybersecurity investments, consumer education campaigns, and biometric authentication tools are essential to gain long-term trust.

Related Report

Key Market Segments

By Product Categories

The South African e-commerce industry is segmented into:

- Apparel and Accessories

- Health and Personal Care and Beauty

- Computer and Consumer Electronics

- Office Equipment and Supplies

- Toys and Hobby

- Furniture and Home Furnishing

- Books/Music/Video

- Others

Among these, Apparel & Electronics are the leading revenue-generating categories, driven by youth fashion trends, frequent online discounts, and expanding tech consumption.

By Payment Mode

The market is segmented by:

- Digital Wallet

- Credit Card

- Debit Card

- Account-to-Account (A2A)

- Buy Now Pay Later (BNPL)

- Cash on Delivery

- Prepay

- Other (Incl. Cryptocurrency)

Digital wallets and BNPL solutions are growing fastest, especially among millennials and Gen Z.

Segment Spotlight: Apparel & Accessories Market

This segment has seen exponential growth due to:

- Youth-driven demand for fast fashion

- Aggressive online marketing & influencer tie-ups

- Platforms like Zando and Superbalist offering curated experiences

- Easy returns and doorstep delivery enhancing user trust

With mobile apps streamlining the experience and the arrival of global brands online, the segment continues to outpace traditional retail growth.

Segment Spotlight: Digital Wallet Market

The South African digital wallet market is gaining ground, with high penetration of mobile banking and fintech apps. As financial inclusion improves, particularly in underbanked communities, digital wallets are bridging payment gaps and promoting safe transactions. Key benefits include:

- Instant payments

- Integration with e-commerce platforms

- Loyalty and cashback features

The government’s push for a cashless economy is expected to further boost digital wallet usage in both urban and rural markets.

Competitive Landscape

Key Players Covered

- Takealot Online Pty Ltd

- Evetech Pty. Ltd

- Jumia

- Walmart Inc.

- Zando

- SoFresh

- Decathlon

- UCook

These companies are analyzed across five viewpoints:

- Overview

- Key Executives

- Recent Developments

- Product Portfolio

- Revenue Metrics

Takealot, backed by Naspers, continues to lead the market, but Amazon’s entry could alter the leadership dynamics drastically in the next few years.

Market Forecast and Future Outlook (2025–2033)

| Year | Market Size (US$ Billion) | CAGR (%) |

| 2024 | 35.23 | — |

| 2033 | 74.79 | 8.79% |

The market outlook remains optimistic, with opportunities for expansion into tier-2 and rural markets. As more consumers come online, and infrastructure catches up, South Africa could emerge as one of Africa’s most mature e-commerce economies.

Key Questions Answered

- What is the expected market size of the South African e-commerce industry in 2033?

- What is the projected compound annual growth rate (CAGR) of the market from 2025 to 2033?

- What are the major drivers fueling e-commerce growth in South Africa?

- How are mobile commerce trends reshaping consumer behavior?

- What challenges does the logistics infrastructure face in South Africa?

- How secure and reliable are digital payments in South Africa?

- Which product categories dominate online sales?

- How has the pandemic impacted online shopping behavior?

- Which companies are leading the South African e-commerce space?

- What are the opportunities for digital wallets and BNPL services?

Report Coverage

| Feature | Details |

| Base Year | 2024 |

| Historical Period | 2020–2024 |

| Forecast Period | 2025–2033 |

| Market Size | US$ Billion |

| Segments | Product Categories, Payment Mode |

| Customization Scope | 20% Free Customization |

| Post-Sale Support | 1 Year |

| Delivery Format | PDF, Excel (Word/PPT available on request) |

Customization Services Available

- Country-specific expansion

- Strategy consultancy

- In-depth competitor analysis

- Entry strategies for new players

- Regional dynamics mapping

- Supply chain analysis

Conclusion

The South African e-commerce industry is at a pivotal growth stage, driven by digital innovation, rising internet usage, and evolving consumer preferences. Companies that invest in robust payment ecosystems, secure logistics, and personalized user experiences will thrive in this high-potential market.