Russia Tequila Market Trends Forecast 2025-2033

Russia Tequila Market Size and Share Analysis – Growth Trends and Forecast Report 2025–2033

Market Overview

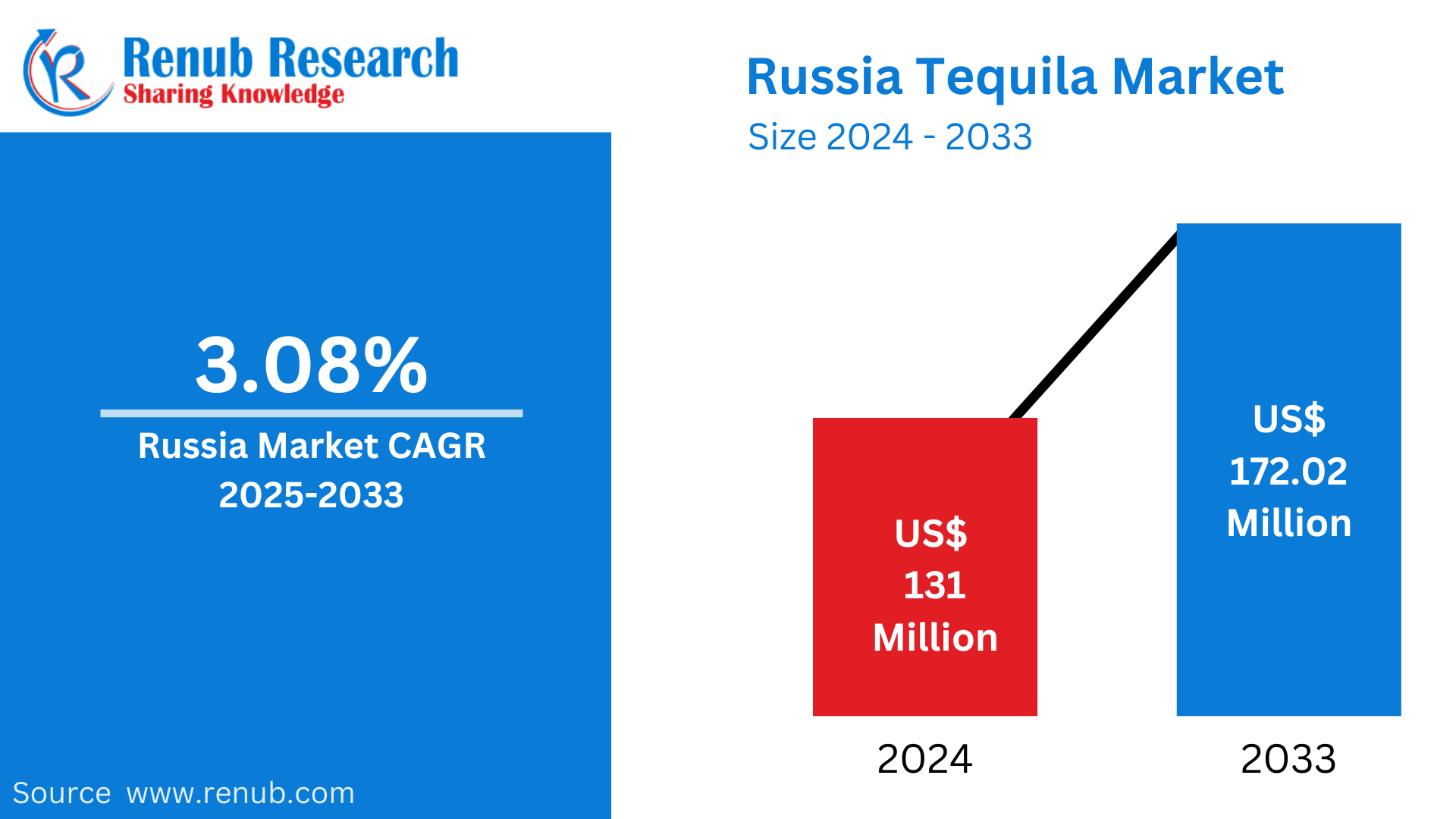

The Russia Tequila Market is projected to reach US$ 172.02 million by 2033, rising from US$ 131 million in 2024, growing at a CAGR of 3.08% during the forecast period 2025–2033. This growth is fueled by several dynamic factors including the increasing presence of bars and restaurants, growing appreciation for Mexican cuisine and culture, expanding cocktail culture, and rising demand for premium and ultra-premium alcoholic beverages.

Industry Insights and Market Dynamics

1. Growing Popularity Amid Changing Consumer Preferences

Although vodka continues to dominate Russia’s alcohol segment, tequila is carving out a niche, especially among younger consumers seeking unique and premium international beverages. Major international brands like Jose Cuervo, Don Julio, and Sauza are leading this market expansion through strategic importation and premium branding efforts.

Tequila’s rising appeal is amplified in urban centers like Moscow and St. Petersburg, where cosmopolitan lifestyles and exposure to global trends are more prominent.

2. Shift Toward Premiumization

One of the strongest growth trends in the Russian alcoholic beverage industry is the shift toward premium and ultra-premium spirits. This is closely tied to increasing disposable income levels. As per OECD, the net-adjusted disposable income per capita in Russia is approximately USD 19,546 annually. Moreover, about 70% of the population between 15–64 years are active in the labor force, signifying a large working demographic open to upscale lifestyle choices.

Luxury tequila brands are now positioned as status symbols, attracting affluent customers and spirit enthusiasts who prioritize exclusivity and refined taste.

Key Market Growth Drivers

Rising Preference for Premium Spirits

Tequila has emerged as a strong contender in Russia’s luxury spirit segment. The appeal lies in its rich heritage, unique production process, and flavor profile. Younger consumers—particularly urban millennials—are drawn to tequila’s authenticity, artisanal value, and global allure. The focus on “quality over quantity” is a core trend bolstering the market.

Expanding Cocktail Culture

Cocktail culture is flourishing in Russian metros, with drinks like Margaritas and Tequila Sunrises becoming staples in bar menus. Bars and lounges are incorporating tequila to meet demand for innovative and diverse beverage experiences. This evolution in drinking habits positions tequila as both a social and sophisticated drink.

Growth of the Hospitality Sector

Russia’s hospitality industry is expanding rapidly, especially in cities like Moscow, St. Petersburg, Kazan, and Yekaterinburg. The growing number of hotels, restaurants, and nightclubs is fostering an environment conducive to tequila promotion and consumption. Premium venues are increasingly stocking high-end tequila to cater to evolving consumer tastes.

Challenges in the Russian Tequila Market

High Import Duties and Stringent Regulations

Tequila is heavily reliant on imports from Mexico, and high import taxes raise the retail price significantly. This makes tequila less competitive compared to locally produced spirits like vodka. Additionally, strict regulatory frameworks concerning alcohol marketing, distribution, and sales further complicate the market landscape.

Limited Local Production Due to Denomination of Origin

Tequila must be produced in specific regions of Mexico to legally carry the name. Hence, local production in Russia is not permitted, making the market entirely dependent on imports. This leads to challenges in supply chain management, including delays, higher transportation costs, and pricing volatility.

Related Report

United States Wine Cooler Market

Regional Market Analysis

Central District (Moscow and Surrounding Areas)

This region is the epicenter of Russia’s tequila market. Moscow’s affluent, globalized consumer base, dense concentration of premium hospitality venues, and high demand for luxury imports make it the top growth area. The cocktail culture is deeply rooted here, offering tequila brands prime exposure.

Volga District

Cities like Kazan and Nizhny Novgorod are witnessing growing interest in tequila driven by a younger, globally-aware population. However, the presence of local alternatives and logistical barriers still restrict widespread adoption.

Urals District

Home to Yekaterinburg, this district reflects similar trends—rising demand in urban hubs versus low penetration in rural zones. International restaurants and cocktail bars are becoming growth hotspots for tequila brands here.

Northwestern, Siberian, and Other Regions

While still nascent, these areas represent emerging opportunities, especially as online retail and digital marketing make it easier to reach consumers across vast geographies.

Russia Tequila Market Segmentation

By Product Type

- Blanco

- Joven

- Reposado

- Anejo

- Others

By Purity

- 100% Tequila

- 60% Tequila

- Others

By Price Range

- Value Tequila

- Premium Tequila

- Premium and Super-Premium Tequila

- Ultra-Premium Tequila

- Others

By Distribution Channel

1. Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

2. On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

By Region

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

Competitive Landscape – Key Players

The Russia Tequila Market is dominated by globally established brands, many of which are part of larger beverage conglomerates:

- Jose Cuervo

- Patron Spirits Company

- Sauza Tequila

- Don Julio

- El Jimador

- Herradura

- 1800 Tequila

- Casamigos

- Milagro Tequila

- Avion Tequila

These companies invest in branding, influencer collaborations, premium packaging, and event marketing to boost their presence in Russia’s emerging tequila market.

Key Questions Answered in the Report

- How big is the Russia Tequila Market?

→ Valued at US$ 131 million in 2024, expected to reach US$ 172.02 million by 2033. - What is the market growth rate?

→ Estimated CAGR of 3.08% from 2025 to 2033. - What are the main growth drivers?

→ Premiumization, cocktail culture, rising disposable incomes, and hospitality expansion. - What challenges does the market face?

→ High import duties, restrictive regulations, and dependence on imported supply. - What segments are covered in the report?

→ Product Type, Purity, Price Range, Distribution Channel, and Region. - Which regions are most promising?

→ Central District (Moscow), followed by Urals and Volga Districts. - Who are the leading players in the Russia tequila market?

→ Global leaders including Jose Cuervo, Don Julio, Patron, Sauza, among others. - How does consumer behavior impact market growth?

→ Preference for premium experiences and international lifestyle influences tequila demand. - How is tequila marketed in Russia?

→ As a premium lifestyle product through bars, high-end stores, and digital platforms. - What is the future outlook?

→ Positive growth driven by premiumization and lifestyle changes, with opportunities in urban markets.