Title: 10 Must-Know Topics for AAT Level 2 Exam

Introduction:

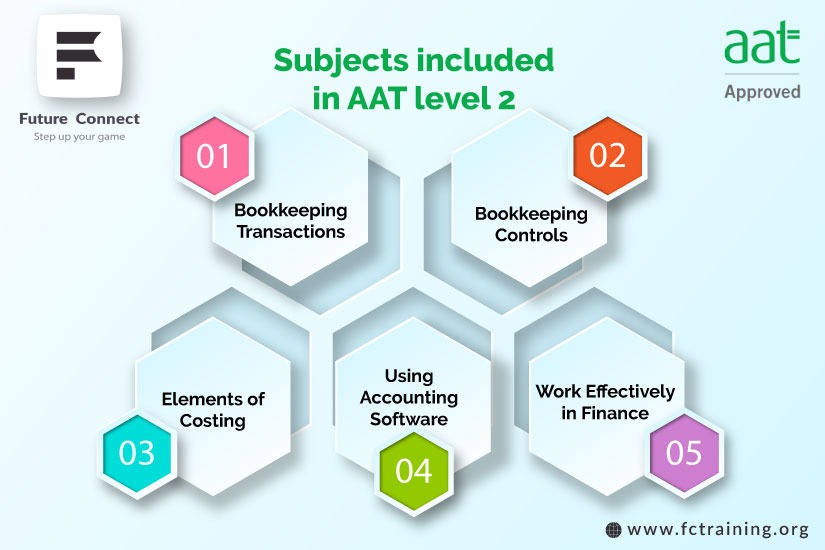

The AAT Level 2 qualification serves as an essential foundation for individuals aspiring to build a career in accounting and finance. This introductory level covers fundamental concepts that lay the groundwork for more advanced studies. As you prepare for the AAT Level 2 exam, understanding the following ten key topics will be crucial for success.

- Bookkeeping Basics:

Bookkeeping is the cornerstone of accounting. AAT Level 2 introduces candidates to the principles of double-entry bookkeeping, where each financial transaction has equal and opposite effects on two accounts. Understanding how to record transactions accurately is fundamental to the entire accounting process. - Financial Transactions:

Mastering the recording and processing of financial transactions is essential. Topics include sales and purchase invoices, receipts, and payments. AAT Level 2 covers the skills needed to accurately record these transactions, ensuring that financial records are complete and error-free. - VAT Returns:

Value Added Tax (VAT) is a significant aspect of financial transactions for many businesses. AAT Level 2 candidates learn how to calculate and record VAT, as well as the process of completing VAT returns. This knowledge is vital for maintaining compliance with tax regulations. - Bank Reconciliation:

Bank reconciliation is a critical skill in accounting. AAT Level 2 covers the process of comparing the financial records of an organization with those of its bank statements. This ensures that discrepancies are identified and resolved, maintaining the accuracy of financial information. - Petty Cash Handling:

Handling petty cash is a common responsibility in entry-level accounting roles. AAT Level 2 includes the management of petty cash systems, teaching candidates how to record transactions, replenish funds, and maintain proper documentation. - Computerized Accounting Software:

Proficiency in accounting software is increasingly important in today’s digital age. AAT Level 2 introduces candidates to basic computerized accounting systems, emphasizing tasks such as data entry, generating reports, and troubleshooting common issues. - Principles of Coding and Batch Control:

AAT Level 2 covers the principles of coding and batch control, emphasizing the importance of systematic organization in accounting processes. Candidates learn how to assign codes to transactions and implement batch control to manage and monitor data accuracy. - Financial Documents and Records:

Understanding various financial documents, such as invoices, credit notes, and statements, is crucial for effective bookkeeping. AAT Level 2 provides insight into the purpose and proper handling of these documents, ensuring candidates can navigate financial records proficiently. - Basic Accounting Ratios:

AAT Level 2 introduces candidates to basic accounting ratios, such as the current ratio and gross profit margin. These ratios provide insights into a company’s financial health and performance, serving as valuable tools for financial analysis. - Ethical Considerations in Accounting:

Ethical behavior is paramount in the accounting profession. AAT Level 2 incorporates topics related to professional ethics, emphasizing the importance of integrity, confidentiality, and compliance with ethical standards in accounting practice.

Conclusion:

As you embark on your AAT Level 2 journey, mastering these ten fundamental topics will set the stage for success in the exam and lay a solid foundation for your future studies in accounting and finance. These skills not only prepare you for the technical aspects of the profession but also instill ethical principles that are essential for a successful career in accounting.